The Unexpected Opportunities Brought by the Cotenancy Ruling for Retailers in California: Who Can Profit the Most?

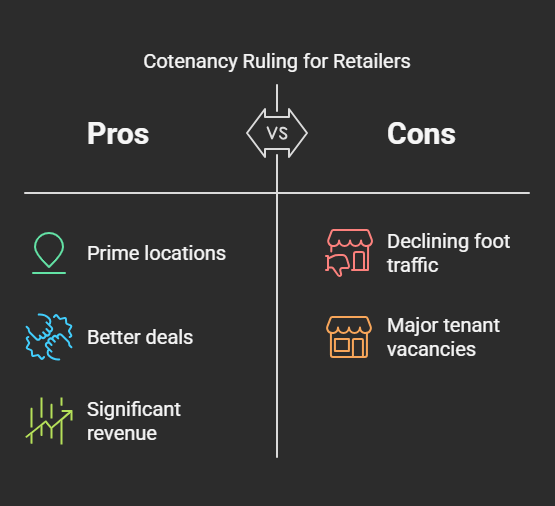

For retailers in California, a recent cotenancy ruling has introduced both challenges and unexpected financial opportunities. Traditionally, cotenancy clauses in lease agreements were designed to protect retailers from declining foot traffic caused by major tenant vacancies in shopping centers. However, as retail landscapes evolve, this ruling has opened new avenues for various businesses and investors to capitalize on prime locations, negotiate better deals, and generate significant revenue.

What is a Cotenancy Clause?

Cotenancy clauses typically allow retailers to demand rent reductions, lease terminations, or other concessions if anchor tenants or a certain percentage of neighboring businesses vacate a retail property. The reasoning behind these clauses is straightforward: fewer stores mean less foot traffic, which can negatively impact sales.

However, a recent legal shift in California has changed how these clauses are interpreted and enforced, bringing new money-making opportunities for retailers, landlords, and real estate investors.

Who Can Profit from the Cotenancy Ruling?

- Retailers Negotiating Lower Rents and Incentives

Retailers can now negotiate more favorable lease terms, leading to significant cost savings and improved profit margins.

Key Benefits:

Lower Base Rent: Retailers can secure long-term lower rent agreements, preserving more cash flow.

Tenant Improvement Allowances: Landlords eager to keep shopping centers occupied may offer financial incentives for renovations.

Reduced Financial Risk: Retailers can now negotiate lease exit strategies that prevent losses if foot traffic declines.

👉 Looking for expert guidance on lease negotiations? Visit Calipad.com for insights and tools to help you secure the best retail spaces!

- Real Estate Investors Buying Prime Retail Properties at Discounts

Shopping centers facing high vacancies due to cotenancy clauses might struggle to find tenants, leading to reduced property values. This creates a prime opportunity for real estate investors to purchase commercial properties at a discount, reposition them with better tenants, and sell or lease at a profit.

How Investors Can Profit:

Buy distressed shopping centers at below-market prices.

Restructure lease agreements with a more profitable mix of tenants.

Introduce multi-use spaces (retail, co-working, entertainment) to increase overall property value.

💡 Discover top real estate investment strategies at Calipad.com – your go-to resource for commercial real estate opportunities.

- Small Business Owners Accessing Prime Locations

Previously, high rental rates in prime retail areas made it difficult for small business owners to compete with larger chains. Due to the cotenancy ruling, landlords are now more willing to offer competitive rental rates to fill vacancies.

Best Opportunities for Small Businesses:

Pop-Up Shops: Entrepreneurs can take advantage of short-term leases at reduced rates.

Startups Testing Retail Presence: E-commerce brands looking to expand into physical retail can now do so affordably.

Franchises Seeking Strategic Locations: Lower rent enables franchise owners to enter high-traffic locations without the high overhead costs.

📌 Ready to expand your business into a prime location? Explore the latest opportunities at Calipad.com!

- Marketing Agencies and E-Commerce Entrepreneurs

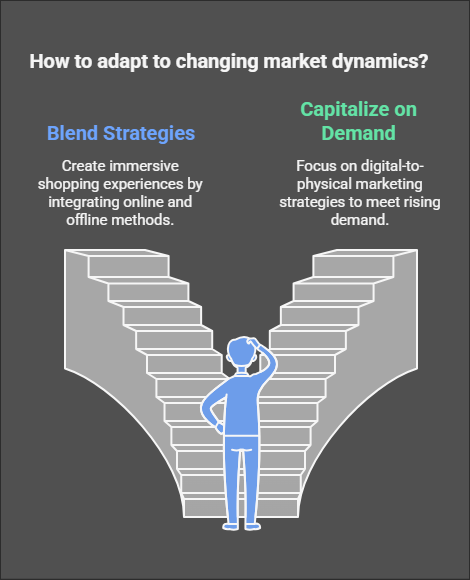

With lower retail rent costs, many e-commerce entrepreneurs are considering hybrid business models where they combine online sales with physical locations. Marketing agencies can also help retailers optimize traffic by leveraging digital tools like geotargeting, influencer marketing, and in-store promotions.

Ways to Profit:

Retailers can blend online and offline strategies to create immersive shopping experiences.

Agencies can capitalize on increased demand for digital-to-physical marketing strategies.

🚀 Boost your marketing strategy with expert insights from Calipad.com and stay ahead of the competition!

How to Monetize the Cotenancy Ruling

- Lease Arbitrage: Turning Discounts into Profit

Entrepreneurs with a good grasp of real estate can lease retail spaces at reduced rates and sublease them to pop-up shops, seasonal businesses, or emerging brands at a profit.

- Retail Space Syndication

Groups of investors can pool funds to buy struggling shopping centers, restructure tenant agreements, and flip properties for major returns.

- Franchise Expansion

Aspiring franchise owners can capitalize on lower commercial rent rates to open new locations at significantly reduced costs, increasing their profit margins.

- Commercial Renovation Services

With landlords offering improvement allowances, contractors and interior designers specializing in retail renovations can see an uptick in business.

Next Steps for Retailers & Investors

If you want to capitalize on this opportunity, here’s what you should do:

Assess your current lease agreements to explore renegotiation options.

Engage with landlords to secure better terms, such as co-marketing initiatives or performance-based rent models.

Use analytics to track foot traffic trends and justify location-based decisions.

Stay updated on legal developments to ensure your lease agreements align with the latest rulings.

Final Thoughts: A Profitable Shift in Retail Real Estate

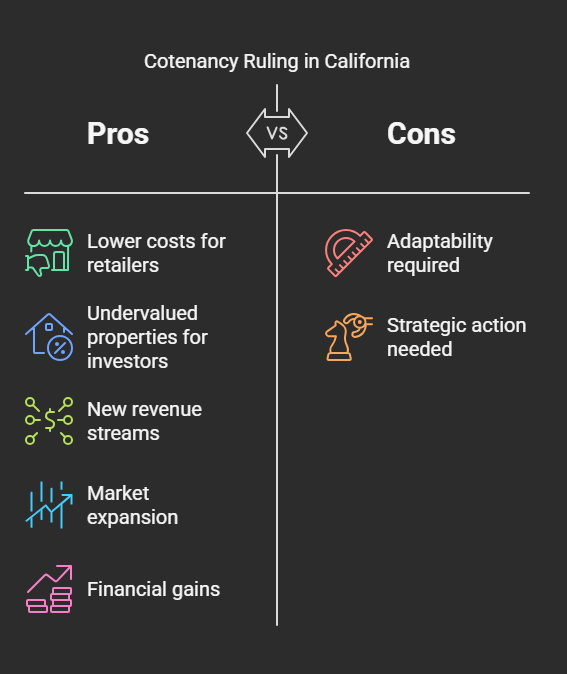

The cotenancy ruling in California has reshaped the retail real estate landscape, offering unexpected profit potential for various players. From retailers negotiating lower costs to investors acquiring undervalued properties, the key to capitalizing on this shift is adaptability and strategic action.

For those willing to seize these new opportunities, the ruling is more than a legal change—it’s a chance to unlock new revenue streams, expand market presence, and drive significant financial gains.

Want More Insights?

If you’re a retailer, investor, or entrepreneur looking to navigate these changes, subscribe to our newsletter for expert insights and exclusive strategies!

🌟 Visit Calipad.com for the latest updates on retail and real estate opportunities in California!